VAT Hunter - Mazars solution for verifying VAT codes

The split VAT payment mechanism, entered into force in 2018, had a major impact for most of the population and for the business environment. In addition to the obligation to verify the validity of the VAT codes of your suppliers and whether they apply VAT upon collection, you have to also verify if such suppliers apply the split VAT payment.

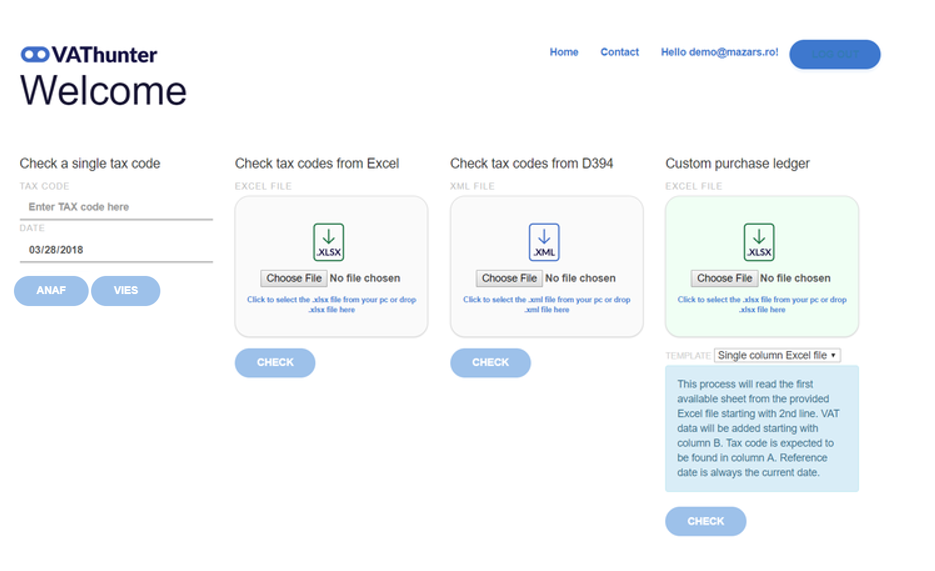

By means of the VAT Hunter application, the companies can verify in real time the status of suppliers/clients in terms of VAT, thus making their reporting process easier.

Why choose VAT Hunter?

- User friendly interface, allowing simultaneous accessing from several devices (desktop, tablet, telephone)

- It does not limit the number of verification you can make simultaneously

- The risk of human error and the risk of potential penalties (0.06/day of the erroneously paid amounts) are reduced

- It is the reliable help for compliance in terms of VAT reporting and obligations

- It significantly reduces the time allocated to manual verification

- It also allows the verification of VAT codes in the VIES database (an essential condition for the companies involved in the cross-border transactions in the EU)

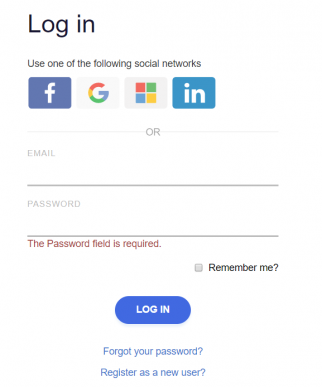

How can I access the application?

VAT Hunter can be found at the following address: http://vathunter.mazars.ro/

You can connect either by creating a user account or through your Facebook, LinkedIn, Gmail accounts.