The application of transfer pricing legislation in the Republic of Moldova enters final stages

Authors:

Liviu Gheorghiu, Tax Director, Mazars in Romania

Alina Ghiță, Tax Manager, Mazars in Romania

Daniela Cojocaru-Lazarev, Tax Consultant, Taxaco

Base erosion and profit shifting are major global tax issues, impacting countries and their economies around the world. Discrepancies between national tax rules undermine the integrity and fairness of the tax system and often lead to aggressive accounting and tax practices aimed at minimising tax liabilities and facilitating profit shifting to other jurisdictions.

International organisations and governments are working together to address these issues and to promote better tax compliance and transparency worldwide. The Actions against Base Erosion and Profit Shifting (BEPS), launched by the Organisation for Economic Cooperation and Development (OECD), aim to curb base erosion practices and ensure a fairer and more efficient tax system. Action 13, one of the 15 OECD actions under the BEPS project, focuses on the need for transparency and documentation regarding transfer pricing.

Transfer prices are defined as the prices charged between related parties. The transfer price principle, also referred to as the arm's length principle requires that transactions between related parties should be set at market prices, i.e. the prices that would have been charged between independent parties in similar circumstances.

Transfer pricing plays a crucial role in the global economy as it relates to commercial transactions and the allocation of profits between related parties operating in different tax jurisdictions. Relationships between related parties in a modern economy are complex and vary according to industry, corporate structure, and business strategy. These relationships may involve cooperation, commercial transactions, sharing of resources and technology, sharing of profits, but also potential conflicts of interest.

Thus, the primary objective of transfer pricing is to avoid underpricing or overpricing of goods and services transacted between related entities, to ensure a fair allocation of profits, and to prevent tax avoidance or profit shifting.

The implementation of the transfer pricing concept in the Republic of Moldova represents a complex process of aligning local legislation to OECD and EU recommendations, but also a significant step towards the creation of a tax system in line with international values and standards.

For the time being, general provisions were introduced in the Tax Code regarding the arm's length principle, the definition of related parties, and minimum thresholds for transactions with related parties to be analysed.

Following the adoption of the Order currently under discussion, which will regulate the obligations of companies concerning the analysis and content of the transfer pricing file, taxpayers will be obliged to comply with the arm's length principle in transactions with related parties when determining taxable income.

The purpose of this article is to provide you with important information on the legislation that will implement the transfer pricing concept.

The subject of taxation

The subject of taxation are companies that carry out transactions with related parties - both tax residents in the Republic of Moldova (locally controlled transaction) and foreign related parties (cross-border transaction).

The affiliation rule includes direct or indirect ownership of at least 25% of the value/number of shares or voting rights of the other legal entity, as well as affiliation through economic control.

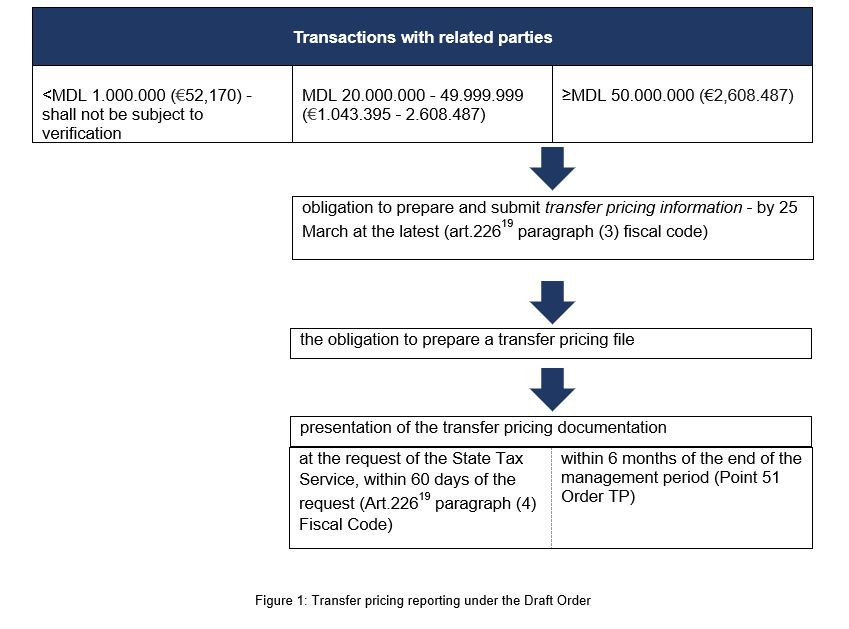

The subject of taxation, the obligation to prepare, the deadline for presentation

The following table shows the tax obligations of companies depending on the value of their annual transactions with related parties[1]:

Information on transfer pricing - statement prepared by the taxpayer who records transactions with related parties exceeding MDL 20,000,000. The filing deadline is 25 March, to present information contained in the transfer pricing file, namely:

- Names of related parties, participating in the controlled transactions;

- Total value of controlled transactions;

- The nature of the related party relationships;

- Details concerning the methodology used to analyse the controlled transaction (type of transaction, object of transaction, tested party, transfer pricing method, profit level indicator chosen).

Transfer pricing file - submission deadline – 30 June, to include in detail:

- Organisational, legal, and operational structure of the company; Company description; Key competitors; Financial information;

- Industry analysis;

- Functional analysis;

- Economic analysis.

According to the current provisions of Article art. 22619 , paragraph (3) of Fiscal Code No. 1163/1997, the transfer pricing information must be submitted no later than the 25th day of the third month following the end of the fiscal period, i.e. 25 March. The deadline for the submission of the transfer pricing file is 6 months after the end of the fiscal period, i.e. 30 June.

In the current form of the draft Order, the deadline for presenting the transfer pricing information is very short, requiring companies to gather information and prepare a series of complex analyses in only 3 months after the end of the financial year.

Functional analysis and economic analysis of controlled transactions

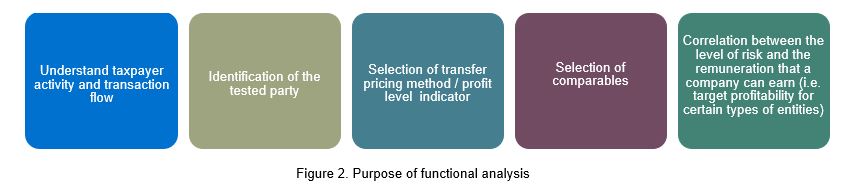

The transfer pricing analysis consists of two stages: functional analysis and economic analysis. Both are essential to ensure tax compliance and avoid disputes with the tax authorities. Through these analyses, the taxpayer must demonstrate that transactions with related parties are conducted at market prices.

The preparation of the analysis implies a complex process and significant responsibility, as the sanctions for non-compliance are substantial.

In the context of the controlled transactions, the functional analysis aims to identify the significant activities of the parties involved from an economic perspective and also in terms of the functions performed, assets used, and risks assumed by each party.

Once the functional profile has been established, the economic analysis can be prepared, which involves assessing the transaction price by reference to the following comparability factors:

- Contractual terms of the transaction;

- Functional profile (functions performed, risks assumed, and assets used);

- Characteristics of goods/services;

- The economic circumstances of companies and of the market in which they operate;

- The geographic criterion of the market in which the related parties operate;

- Business strategies.

According to the OECD Guidelines and the draft Order, the following methods are used to determine the arm's length transfer prices for transactions between related parties: comparable uncontrolled price method, resale price method, cost-plus method, net margin method, profit-split method and any other method recognised by the OECD.

The most appropriate method of analysis is chosen based on the nature of the transaction, the functional profile, and the information available to each taxpayer. The difficulty of the analysis often lies in identifying transactions or comparable prices established between independent companies.

Transactions between related parties are considered to be at arm's length if the economic and financial indicators of profitability or the margin/result/price of the transaction fall within the lower and upper quartile of the range of comparable prices.

If the price applied in controlled transactions does not fall within the range, the taxpayer will be subject to fines from the State Fiscal Service during thematic inspections.

In addition, according to the draft Order, related parties have the right to voluntarily adjust transfer prices, provided that such adjustment does not reduce the income tax declared to the budget.

Finally, to comply with transfer pricing regulations and avoid potential legal issues, we offer the following recommendations for taxpayers:

- Presentation by the subsidiary to the group of the legislative requirements of the Republic of Moldova about the concept of transfer pricing and planning the preparation of the file;

- Identifying transactions with related parties and related documents (contracts, invoices, statements, etc.);

- For the most significant transactions, we recommend the early preparation of the analysis, through which potential risks can be identified and possibly addressed prior to future audits. We suggest that the collection of information and the preliminary analysis of transactions should start from January 2024, as the first year of application of the new rules is likely to be 2024;

- Consult a transfer pricing specialist to guide you through the process and ensure that the documentation and analysis are accurate.

[1] Please note that these thresholds are subject to change in the final form of the legislation.